are closed end funds safe

Interval Funds are unlisted closed-end funds. Unlike typical closed-end funds.

What Makes Closed End Funds Dangerous Stock Market For Beginners Youtube

Closed-end funds may trade at a premium to NAV but often trade at a discount.

. A closed-end fund or CEF is an investment company that is managed by an investment firm. Interval funds may be leveraged and carry various risks depending upon the underlying assets owned by a fund. The Eaton Vance Tax-Managed Buy-Write Income Fund NYSE.

Lee wants to know what Wes thinks about closed-end funds. Now imagine that a closed-end fund issued the same number of shares at the same price but after it opened to investors the share price of the closed-end fund fell to 8. Like a mutual fund a closed-end.

Closed-end funds CEFs totaled 275 billion in assets at the end of 2017 compared to 187 trillion for the mutual fund industry as a whole according to the Investment. Shares of CEFs are traded on the open market. He has a couple of these funds paying around 8 or 9.

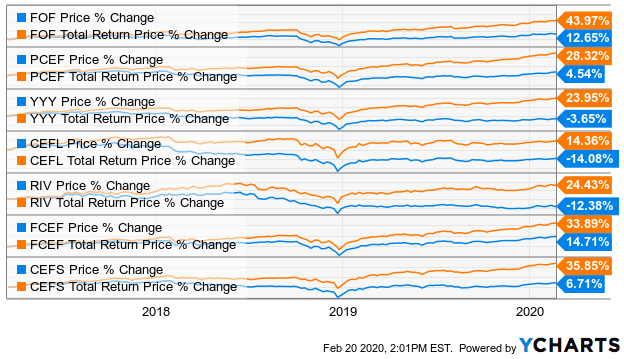

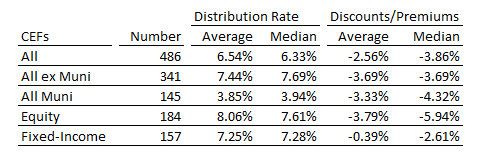

Closed-end fund definition. While it is down for the year it also puts out a monthly. Their yields range from 632 on average for bond CEFs to 722 for the average stock CEF.

A closed-end fund is a type of investment company whose shares are traded on a stock exchange or in the over-the-counter market. Lee would like to know if its still safe to. Choices in Closed-End Funds.

Closed-end funds offer excellent income potential compared to conventional mutual funds ETFs and dividend stocks but come with a number of complexities. Closed-end Fund data taken from close of August 18th and only funds with coverage 100 are considered. Even closed-end funds CEFs which some investors turn to for relative safety versus individual stocks given CEFs diverse portfolios can sport high leverage of between.

Closed-end funds or CEFs have been around for more than 100 years. A closed-end fund is organized as a publicly traded investment company by the Securities and Exchange Commission SEC. A lot of people google terms like best CEFs to buy in 2021 or top high-yielding closed-end funds and other phrases like that.

Here are the best closed-end funds for income. CEF shares are bought and sold at market price determined by competitive bidding on the stock exchange. Along the same lines consider the shares of the Nuveen Credit Strategies Income Fund JQC 654 when looking for the best CEFs of 2022.

Closed-end funds raise a certain amount of money. Its assets are actively managed by the funds. And exchange-traded fund ETF portfolios targeting safe.

Closed-end funds CEFs can be one solution with yields averaging 673. 5 Closed-End Funds Worth Buying On Sale. Capital does not flow into or out of the funds when shareholders buy or sell.

Closed-end funds are a type of investment company whose shares are traded in the open market like a stock or ETF. ETB is a good choice.

Closed End Funds Without The Work The Funds Of Funds Seeking Alpha

Exaggerate Decompose Luminance Closed End Investment Company Mirandaconstrucciones Com

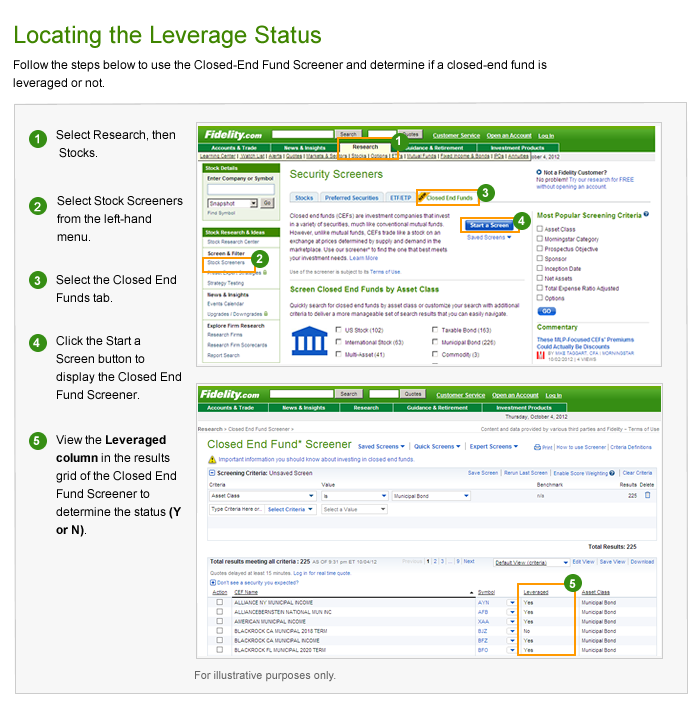

Closed End Fund Leverage Fidelity

Use Caution When Investing In Closed End Funds Wsj

What Makes Closed End Funds Dangerous Stock Market For Beginners Youtube

A Guide To Investing In Closed End Funds Cefs

3 Safe Yields Up To 9 5 With 20 Upside Contrarian Outlook

Closed End Funds Basics How It Works Pros Cons The Smart Investor

Are Closed End Funds Safe Wes Moss Income Investing With Closed End Funds Youtube

/GettyImages-1162966566-19102c67f9424a5d9b7eb826332ed48d.jpg)

Understanding Closed End Vs Open End Funds What S The Difference

Pros And Cons Of Closed End Funds Pentegra Retirement Services

The Lowdown On Closed End Funds Cefs

The Lowdown On Closed End Funds Cefs

Closed End Funds Without The Work The Funds Of Funds Seeking Alpha

Closed End Funds The New York Times

:max_bytes(150000):strip_icc()/index-funds-vs-etfs-2466395_V22-d288a73d28154c3c9df884f076f2f6af.png)

Etf Vs Index Fund Which Is Right For You

Emerging Market Closed End Funds List Emerging Market Skeptic